Real Estate Is Voted the Best Long-Term Investment 12 Years in a Row

In a recent poll from Gallup, real estate has once again been voted the best long-term investment. And it’s claimed that top spot for 12 straight years now. That’s because homeownership is one of the top ways to build your wealth, even with home price growth moderating and ongoing economic uncert

Read MoreThinking about an Adjustable-Rate Mortgage? Read This First.

If you’ve been house hunting lately, you’ve probably felt the sting of today’s mortgage rates. And it’s because of those rates and rising home prices that many homebuyers are starting to explore other types of loans to make the numbers work. And one option that’s gaining popularity? Adjustable-ra

Read MoreMore Homes for Sale Isn’t a Warning Sign – It's Your Buying Opportunity

Maybe you’ve heard the number of homes for sale has reached a recent high. And it might make you question if this is the start of another housing market crash. But the reality is, the data proves that’s just not the case. In most areas, more inventory isn’t bad news. It’s actually a sign of the m

Read MoreWhat Buyers Need To Know About Homeowners Association Fees

When buying a home, you’re probably thinking about mortgage rates, home prices, your down payment, and maybe even your closing costs. But you may not be thinking about homeowners association (HOA) fees. While you won’t necessarily have these, you should know it’s a possibility, depending on where

Read MoreYou Could Use Some of Your Equity To Give Your Children the Gift of Home

If you’re a homeowner, chances are you’ve built up a lot of wealth – just by living in your house and watching its value grow over time. And that equity? It’s something that could help change your child’s life. Since affordability is still a challenge, a lot of first-time buyers are struggling to

Read MoreHousing Market Forecasts for the Second Half of 2025

Are you wondering what to expect if you buy or sell a home in the second half of the year? Here’s what the expert forecasts tell you. Mortgage rates are expected to come down slightly. There will be more homes available for sale. And as inventory rises, home price growth will moderate. Want to kn

Read MoreHousing Market Forecasts for the Second Half of 2025

Why Would I Move with a 3% Mortgage Rate?

If you have a 3% mortgage rate, you’re probably pretty hesitant to let that go. And even if you’ve toyed with the idea of moving, this nagging thought may be holding you back: “why would I give that up?” But when you ask that question, you may be putting your needs on the back burner without real

Read MoreDon’t Let Student Loans Hold You Back from Homeownership

Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you're wondering: Do you have to wait until you’ve paid off those loans before you can buy your first home? Or is it possible you coul

Read MoreWhy Buyers Are More Likely To Get Concessions Right Now

Especially in areas where inventory is rising, both homebuilders and sellers are sweetening the deal for buyers with things like paid closing costs, mortgage rate buy-downs, and more. In the industry, it’s called a concession or an incentive. What Are Concessions and Incentives? When a seller or

Read MoreHome Projects That Boost Value

Whether you’re planning to move soon or not, it’s smart to be strategic about which home projects you take on. Your time, energy, and money matter – and not all upgrades offer the payoff you might expect. As U.S. News Real Estate explains: ". . . not every home renovation project will increase th

Read MoreWhy You’ll Want a Home Inspection

Once your offer is accepted, an inspector will assess the condition of the house, including things like the roof, foundation, plumbing, and more. That information is incredibly important and paves the way for you to re-negotiate with the seller, as needed. So, you don’t want to skip this step. An i

Read MoreWhy You’ll Want a Home Inspection

An inspection is an important part of the homebuying process. And it's one you don’t want to skip. Let’s connect to talk about other ways to make your offer stand out.

Read MoreHousing Market Forecasts for the Second Half of the Year

From rising home prices to mortgage rate swings, the housing market has left a lot of people wondering what’s next – and whether now is really the right time to move. There is one place you can turn to for answers you want the most. And that’s the experts. Leading housing experts are starting to

Read MoreWhy Some Homes Sell Faster Than Others

As you think ahead to your own move, you may have noticed some houses sell within days, while others linger. But why is that? As Redfin says: “. . . today’s housing market has been topsy-turvy since the pandemic. Low inventory (though rising) and high prices have created a strange mix: Some homes a

Read MoreStocks May Be Volatile, but Home Values Aren’t

With all the uncertainty in the economy, the stock market has been bouncing around more than usual. And if you’ve been watching your 401(k) or investments lately, chances are you’ve felt that pit in your stomach. One day it’s up. The next day, it’s not. And that may make you feel a little worried a

Read MoreThe 20% Down Payment Myth, Debunked

Saving up to buy a home can feel a little intimidating, especially right now. And for many first-time buyers, the idea that you have to put 20% down can feel like a major roadblock. But that’s actually a common misconception. Here’s the truth. Do You Really Have To Put 20% Down When You Buy a Home?

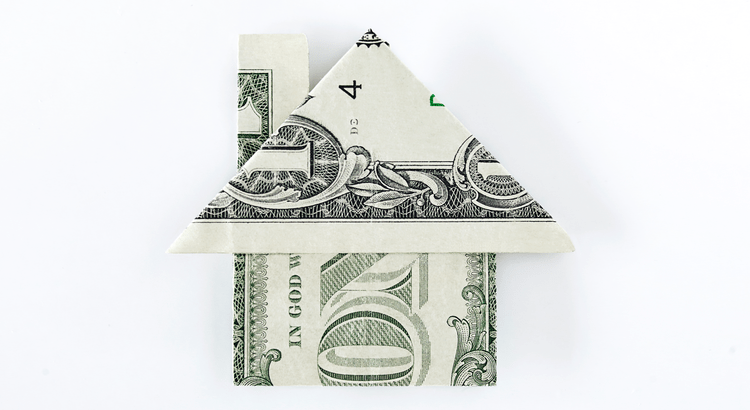

Read MoreYour Home Equity Could Make Moving Possible

Thanks to recent home price appreciation, homeowners have near record amounts of equity – and you may too. On average, homeowners have $311K worth of equity. Once you sell, you can use it to fund your down payment on your next home or maybe even to buy a smaller house in cash. If you want to find o

Read MoreYour Home Equity Could Make Moving Possible

The average homeowner has $311K worth of equity built up. If you want to find out how much equity you have and how you can use it to fuel your move, let's connect.

Read MoreWhat an Economic Slowdown Could Mean for the Housing Market

Talk about the economy is all over the news, and the odds of a recession are rising this year. That’s leaving a lot of people wondering what it means for the value of their home – and their buying power. Let’s take a look at some historical data to show what’s happened in the housing market during

Read More

Categories

- All Blogs 441

- Affordability 37

- Agent Value 58

- Buying Tips 120

- Downsize 6

- Economy 30

- Equity 35

- First-Time Buyers 78

- Fishers 1

- For Buyers 262

- For Sale By Owner 8

- For Sellers 178

- Forecasts 25

- Foreclosures 10

- Home Prices 91

- Inventory 56

- Luxury/Vacation 2

- Mortgage Rates 81

- Move-Up 5

- New Construction 16

- Rent vs. Buy 19

- Selling Tips 90

- Senior Market 2

Recent Posts