The Fall Buyer and Seller Guides Are Here

The Fall Buyer and Seller Guides are here. Let’s connect so you can get the latest digital copies of these guides.

Read MoreBuilder Incentives Reach 5-Year High

Even with more homes on the market right now, some buyers are still having a tough time finding the right one at the right price. Maybe the layout feels off. Maybe it still needs some updating. Or maybe it’s just more of the same. That’s why more buyers are turning to new construction – and findi

Read MoreFrom Frenzy to Breathing Room: Buyers Finally Have Time Again

If you tried to buy a home a few years ago, you probably still remember the frenzy. Homes were listed one day and gone the next. Sometimes it only took hours. You had to drop everything to go and see the house, and if you hesitated even slightly, someone else swooped in and bought it – sometimes ev

Read MoreCondos Could Be a Win for Today’s Buyers

Not every homebuyer wants the biggest house on the block. Some want something simpler, more affordable, and easier to maintain, especially in a market where every dollar counts. That’s where condos come in. For first-time buyers, they can be a smart way to get into homeownership without stretchin

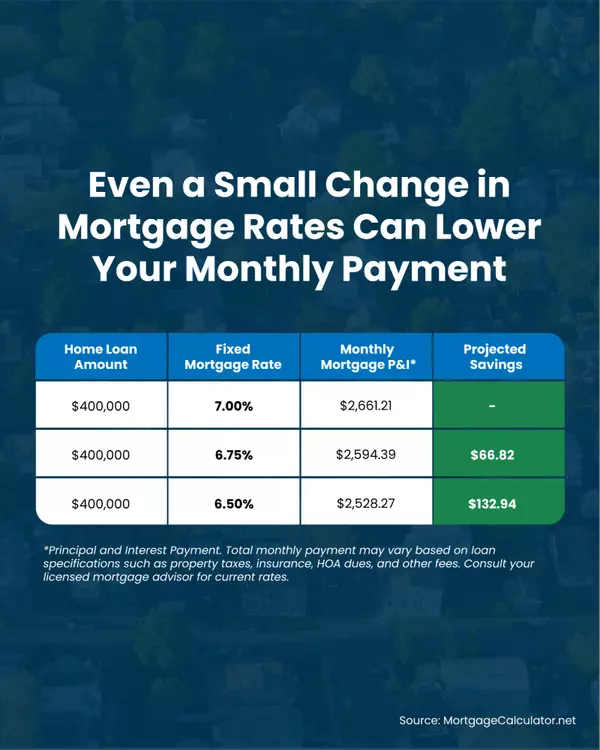

Read MoreHow Changing Rates Impact Your Monthly Payment

Even a small shift in mortgage rates can make a big difference in your monthly payment. Want to stay on top of rate changes and what they mean for your budget? Let’s connect.

Read More3 Advantages of Buying a Newly Built Home Today

Prices, rates, and finding the right home are three of the biggest challenges for buyers today. You may find better luck with all 3 if you look at newly built homes. There are more available. Builders are more flexible on prices right now. And people who buy new homes tend to get lower rates in thi

Read MoreThe Truth About Down Payments (It’s Not What You Think)

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in. “I’ll never save enough.” “I need a small fortune just to get started.” “I guess I’ll just rent forever.” Sound familiar? You’re not alone. And you’re definitely not out of luck. Here’s the

Read More2 Advantages of Buying a Newly Built Home Today

Since there are more new homes on the market, builders are motivated to sell and that’s leading to two great perks: price cuts and lower rates. Let’s connect if you want to see what builders are offering in our area.

Read More3 Advantages of Buying a Newly Built Home Today

Prices, rates, and finding the right home are three of the biggest challenges for buyers today. You may find better luck with all 3 if you look at newly built homes. There are more available. Builders are more flexible on prices right now. And people who buy new homes tend to get lower rates in thi

Read MoreWhat Credit Score Do You Really Need To Buy a Home?

According to Fannie Mae, 90% of buyers don’t actually know what credit score lenders are looking for, or they overestimate the minimum needed. Let that sink in. That means most homebuyers think they need better credit than they actually do – and maybe you’re one of them. And that could make you t

Read MoreWhy a Newly Built Home Might Be the Move Right Now

Are you looking for better home prices, or even a lower mortgage rate? You might find both in one place: a newly built home. While many buyers are overlooking new construction, it could be your best opportunity in today’s market. Here’s why. There are more brand-new homes available right now than

Read MoreThe Advice First-Time Homebuyers Need To Hear

Buying your first home is a big milestone – and the right support is going to make it a whole lot easier. Because while this process might be brand new to you, it’s not new to your agent. They’ve helped plenty of first-time buyers through it. They know what works, what actually matters, and how y

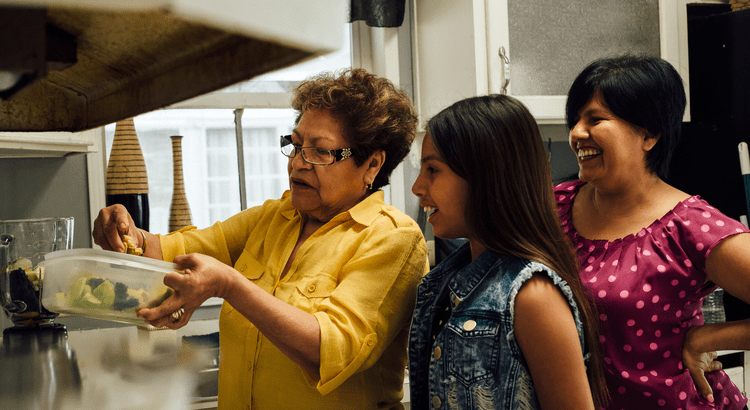

Read MoreMulti-Generational Homebuying Hit a Record High – Here’s Why

Multi-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below): And what’s behind the increase? Affordab

Read More3 Reasons To Buy a Home This Summer

Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do next. But here’s something only the savviest buyers realize: This summer might actually be the best time to buy in years. Here are three big reasons

Read MoreWhat You Really Need To Know About Down Payments

A lot of people think you have to put 20% down when you buy your first home. But that’s actually a common myth. Connect with a trusted lender to learn more.

Read MoreWhat You Really Need To Know About Down Payments

Buying Your First Home? FHA Loans Can Help

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan. They’re designed to he

Read MoreBuying Your First Home? FHA Loans Can Help

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan. They’re designed to he

Read MoreThe Summer Guides for Buying or Selling a Home Are Here

The Summer Guides for buying or selling a home are here. Let’s connect so you can get the latest digital copies of these guides.

Read MoreUnderstanding Today’s Mortgage Rates: Is 3% Coming Back?

A lot of buyers are pressing pause on their plans these days, holding out hope that mortgage rates will come down – maybe even back to the historic-low 3% from a few years ago. But here’s the thing: those rates were never meant to last. They were a short-term response to a very specific moment in t

Read More

Categories

- All Blogs 441

- Affordability 37

- Agent Value 58

- Buying Tips 120

- Downsize 6

- Economy 30

- Equity 35

- First-Time Buyers 78

- Fishers 1

- For Buyers 262

- For Sale By Owner 8

- For Sellers 178

- Forecasts 25

- Foreclosures 10

- Home Prices 91

- Inventory 56

- Luxury/Vacation 2

- Mortgage Rates 81

- Move-Up 5

- New Construction 16

- Rent vs. Buy 19

- Selling Tips 90

- Senior Market 2

Recent Posts