Condos Could Be a Win for Today’s Buyers

Not every homebuyer wants the biggest house on the block. Some want something simpler, more affordable, and easier to maintain, especially in a market where every dollar counts. That’s where condos come in. For first-time buyers, they can be a smart way to get into homeownership without stretchin

Read MoreHow Changing Rates Impact Your Monthly Payment

Even a small shift in mortgage rates can make a big difference in your monthly payment. Want to stay on top of rate changes and what they mean for your budget? Let’s connect.

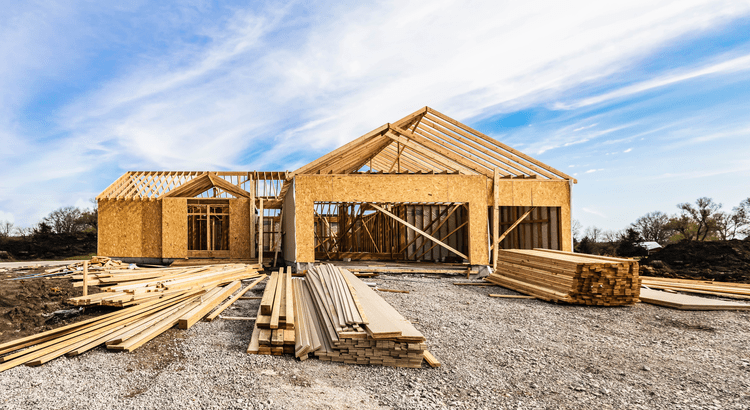

Read MoreAre These Myths About Buying a Newly Built Home Holding You Back?

If you’ve been skipping over newly built homes in your search, you might be doing so based on outdated assumptions. Let’s clear up a few of the most common myths, so you don’t miss out on a solid opportunity. Myth 1: New Homes Are More Expensive It’s easy to assume a new build will cost more than

Read More3 Advantages of Buying a Newly Built Home Today

Prices, rates, and finding the right home are three of the biggest challenges for buyers today. You may find better luck with all 3 if you look at newly built homes. There are more available. Builders are more flexible on prices right now. And people who buy new homes tend to get lower rates in thi

Read MoreThe Truth About Down Payments (It’s Not What You Think)

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in. “I’ll never save enough.” “I need a small fortune just to get started.” “I guess I’ll just rent forever.” Sound familiar? You’re not alone. And you’re definitely not out of luck. Here’s the

Read More2 Advantages of Buying a Newly Built Home Today

Since there are more new homes on the market, builders are motivated to sell and that’s leading to two great perks: price cuts and lower rates. Let’s connect if you want to see what builders are offering in our area.

Read More3 Advantages of Buying a Newly Built Home Today

Prices, rates, and finding the right home are three of the biggest challenges for buyers today. You may find better luck with all 3 if you look at newly built homes. There are more available. Builders are more flexible on prices right now. And people who buy new homes tend to get lower rates in thi

Read MoreWhy a Newly Built Home Might Be the Move Right Now

Are you looking for better home prices, or even a lower mortgage rate? You might find both in one place: a newly built home. While many buyers are overlooking new construction, it could be your best opportunity in today’s market. Here’s why. There are more brand-new homes available right now than

Read MoreMulti-Generational Homebuying Hit a Record High – Here’s Why

Multi-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below): And what’s behind the increase? Affordab

Read MoreWhy Your Home's Asking Price Matters More Today

Now that there are more homes for sale, the number of price cuts is back at normal levels. Want a proven pricing strategy that works for today's market? Let's connect.

Read MoreBuying Your First Home? FHA Loans Can Help

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan. They’re designed to he

Read MoreBuying Your First Home? FHA Loans Can Help

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan. They’re designed to he

Read MoreThe Summer Guides for Buying or Selling a Home Are Here

The Summer Guides for buying or selling a home are here. Let’s connect so you can get the latest digital copies of these guides.

Read MoreNewly Built Homes May Be Less Expensive Than You Think

Do you think a brand-new home means a bigger price tag? Think again. Right now, something unique is happening in the housing market. According to the Census and the National Association of Realtors (NAR), the median price of newly built homes is actually lower than the median price for existing h

Read MoreThe 20% Down Payment Myth, Debunked

Saving up to buy a home can feel a little intimidating, especially right now. And for many first-time buyers, the idea that you have to put 20% down can feel like a major roadblock. But that’s actually a common misconception. Here’s the truth. Do You Really Have To Put 20% Down When You Buy a Home?

Read MoreThe Perks of Buying a Fixer-Upper

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner. If you’re willing to roll up your sleeves (or hire someone who will), buying a house that needs some work could open the door to homeownership. Here’s everything

Read MoreTwo Resources That Can Help You Buy a Home Right Now

A recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s the thing. With the right resources and help, you can

Read MoreWhy Moving to a More Affordable Area Makes Sense

Moving to a more affordable area could be the fresh start you need to get ahead financially. While some markets are certainly more affordable than others, know that working with a trusted real estate agent to find what fits your budget and your desired location – no matter where you want to be – is

Read MoreWhat Will It Take for Prices To Come Down?

You may be wondering if home prices are going to crash. And believe it or not, some people might even be hoping this happens so they can finally purchase a more affordable home. But experts agree that's not what's in the cards – and here's why. There are more people who want to buy a home than ther

Read MoreIs a Fixer Upper Right for You?

Looking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive into why buying a fixer upper could be your ticket to homeowner

Read More

Categories

- All Blogs 441

- Affordability 37

- Agent Value 58

- Buying Tips 120

- Downsize 6

- Economy 30

- Equity 35

- First-Time Buyers 78

- Fishers 1

- For Buyers 262

- For Sale By Owner 8

- For Sellers 178

- Forecasts 25

- Foreclosures 10

- Home Prices 91

- Inventory 56

- Luxury/Vacation 2

- Mortgage Rates 81

- Move-Up 5

- New Construction 16

- Rent vs. Buy 19

- Selling Tips 90

- Senior Market 2

Recent Posts