The Big Difference Between a Homeowner’s and a Renter’s Net Worth

Homeownership is one of the best ways to build wealth in our country and it’s easy to see why. As you pay down your mortgage and as home values rise over time, you gain equity – and that helps grow your net worth. That’s why a homeowner’s net worth is nearly 40X greater than a renters. But you should only buy a home when you’re ready and able to do it. If you want to build a plan to get there, let’s connect.

Categories

- All Blogs 374

- Affordability 24

- Agent Value 49

- Buying Tips 101

- Downsize 4

- Economy 28

- Equity 31

- First-Time Buyers 61

- Fishers 1

- For Buyers 217

- For Sale By Owner 7

- For Sellers 139

- Forecasts 18

- Foreclosures 8

- Home Prices 74

- Inventory 49

- Luxury/Vacation 2

- Mortgage Rates 69

- Move-Up 3

- New Construction 9

- Rent vs. Buy 16

- Selling Tips 76

Recent Posts

The Big Difference Between Homeowner and Renter Net Worth

The Big Difference Between a Homeowner’s and a Renter’s Net Worth

The Rooms That Matter Most When You Sell

Understanding Today’s Mortgage Rates: Is 3% Coming Back?

Why Buying Real Estate Is Still the Best Long-Term Investment

Newly Built Homes May Be Less Expensive Than You Think

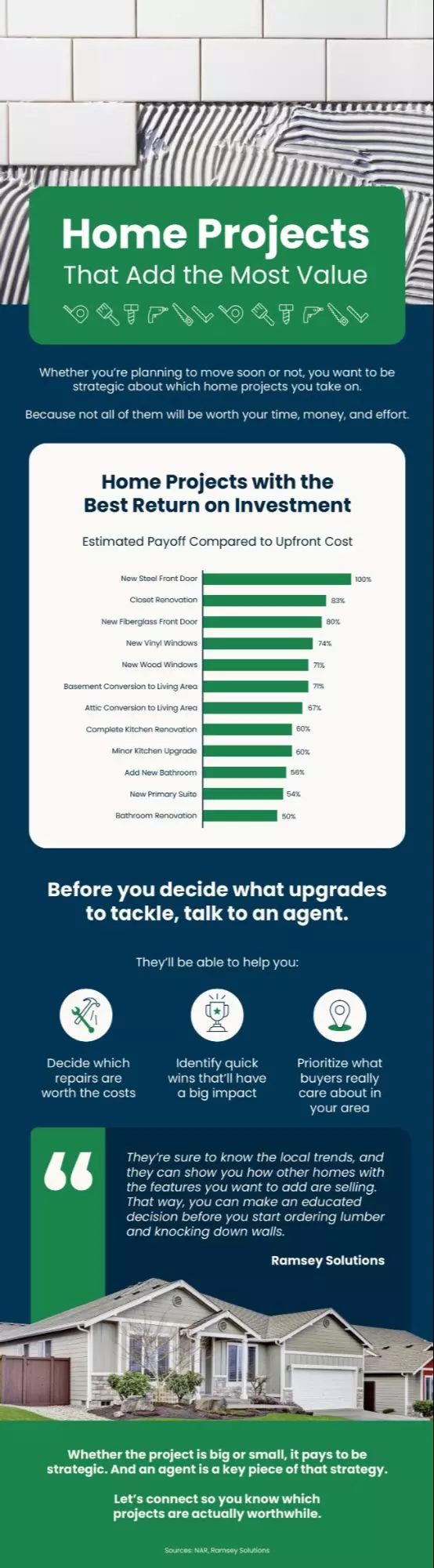

Home Projects That Add the Most Value

Home Projects That Add the Most Value Home Projects That Add the Most Value

Is It Better To Rent or Buy a Home?

The Secret To Selling Your House in Today’s Market