Unlocking the Benefits of Your Home's Equity

Equity is the difference between what your house is worth and what you still owe on your mortgage. The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity. Want to know how much equity you have? Let’s connect so you can get a Professional Equity Assessment Report (PEAR).

Categories

- All Blogs 470

- Affordability 44

- Agent Value 60

- Buying Tips 125

- Downsize 7

- Economy 34

- Equity 37

- First-Time Buyers 85

- Fishers 1

- For Buyers 280

- For Sale By Owner 8

- For Sellers 196

- Forecasts 28

- Foreclosures 11

- Home Prices 99

- Inventory 59

- Luxury/Vacation 2

- Mortgage Rates 88

- Move-Up 6

- New Construction 17

- Rent vs. Buy 19

- Selling Tips 100

- Senior Market 2

Recent Posts

Why Some Homes Sell Quickly – and Others Don’t Sell at All

The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

Planning To Sell in 2026? Start the Prep Now

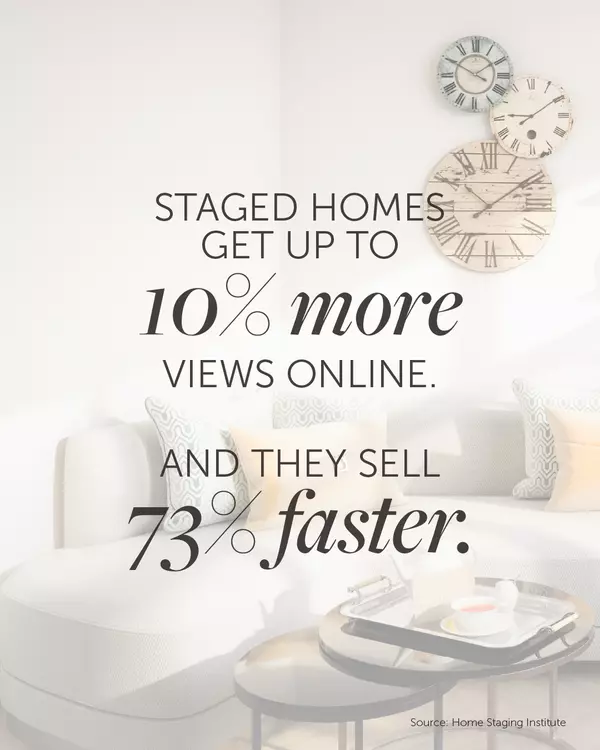

Staged Homes Sell 73% Faster

Is the Housing Market Going To Crash? Here’s What Experts Say

2026 Housing Market Outlook

1 in 5 Sellers Are Cutting Prices Right Now

Why More Buyers Are Turning to New Construction This Year

The $280 Shift in Affordability Every Homebuyer Should Know

Don’t Let Unrealistic Pricing Cost You Your Move