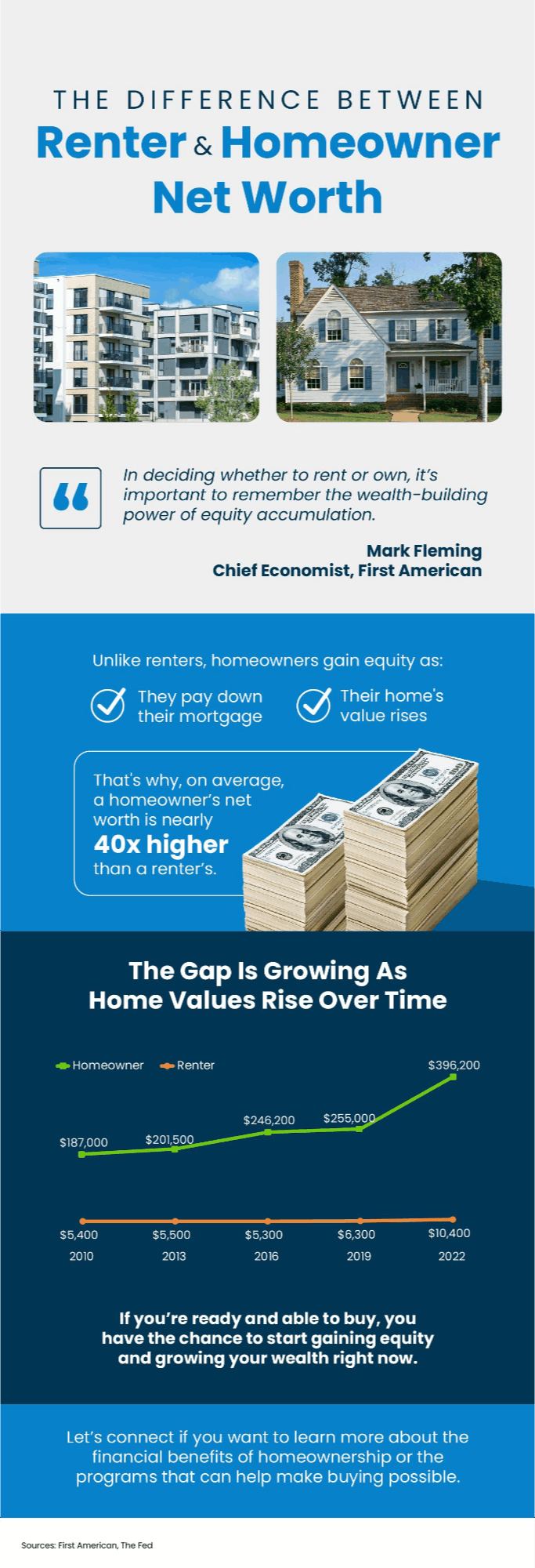

The Big Difference Between Renter and Homeowner Net Worth

If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership. Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s. Let’s connect if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

Categories

- All Blogs 518

- Affordability 54

- Agent Value 61

- Buying Tips 138

- Downsize 9

- Economy 36

- Equity 44

- Expired/ Withdrawn/ Canceled 2

- Featured 1

- First-Time Buyers 99

- Fishers 1

- For Buyers 308

- For Sale By Owner 9

- For Sellers 223

- Forecasts 31

- Foreclosures 11

- Home Prices 104

- Inventory 70

- Luxury/Vacation 2

- Mortgage Rates 95

- Move-Up 10

- New Construction 19

- Price It Right/ Over Pricing 1

- Rent vs. Buy 21

- Selling Tips 112

- Senior Market 2

Recent Posts

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

The Share of Homeowners Selling with an Agent Just Hit a New All-Time High

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

Your House Didn’t Sell. What Now?

Headlines Have You Worried about Your Home’s Value? Read This.

96% of Homes Are Worth More Than What Their Owners Paid

Is January the Best Time To Buy a Home?

January Buyers Could Save Thousands